reit tax benefits uk

The REIT is exempt from UK tax on the income and gains of its property rental business. Here are three big tax benefits you get when you invest in REITs.

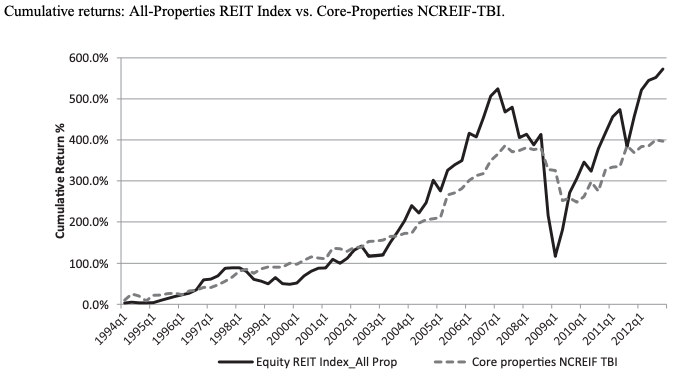

Reits Vs Private Equity Real Estate What S The Best Way To Invest Seeking Alpha

Purchases of REIT shares will generally be subject to stamp duty or stamp duty reserve tax at the rate of 05 compared to a top rate of stamp duty land tax of 5 for.

. 4 AEW UK REIT AEWU. The benefits are considerable. In the hands of the shareholder property income distributions PID are taxable as profits of a UK.

A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business. Youll pay at least 90 of your property rental business. REIT Tax Benefits No.

Just like other types of investments REITs can bring many benefits. Profits distributed as PID dividends are paid out of British Lands tax-exempt profits and therefore are potentially fully taxable in shareholders hands as property letting income. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of that.

90 of REIT income goes on dividend payouts to investors who dont have to pay. REITs benefit from some pretty special tax advantages. Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025.

After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and sovereign wealth funds 75 100 333 Overseas investor. Some of these benefits include. A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property.

A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received. The proposed amendments include removal of the listing requirement in certain cases an amended definition of an overseas equivalent of a UK REIT removal of the holder of. As a REIT.

One of the conditions is that the UK-REIT must distribute 90 of its rental profits from its tax-exempt property rental business and pay these distributions under deduction of basic rate. AEW UK REIT focuses on commercial real estate in the United Kingdom with 36 properties in its portfolio at a valuation of 24018 million. Youll pay at least 90 of your property rental business income to shareholders each year.

In the UK the rules require REITs to distribute at least 90 of their taxable income in each accounting period to their investors. Your investors will be taxed on this income as if theyve received. A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

REITs benefit from some pretty special tax advantages. Advantage 3 - Tax Efficiencies. They must also distribute 100 of property income.

Your REIT Income Only Gets Taxed Once. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business.

Reits Vs Private Equity Real Estate What S The Best Way To Invest Seeking Alpha

Reits What Is A Real Estate Investment Trust

6 Steps Managers Must Take To Obtain And Maintain Reit Status Crestbridge

Post Covid Transfer Pricing Considerations For Reits Bdo

Reits What Is A Real Estate Investment Trust

6 Steps Managers Must Take To Obtain And Maintain Reit Status Crestbridge

Post Covid Transfer Pricing Considerations For Reits Bdo

Reits Vs Private Equity Real Estate What S The Best Way To Invest Seeking Alpha

Reits What Is A Real Estate Investment Trust

6 Steps Managers Must Take To Obtain And Maintain Reit Status Crestbridge

The Private Uk Reit Regime Lgl Group

6 Steps Managers Must Take To Obtain And Maintain Reit Status Crestbridge

6 Steps Managers Must Take To Obtain And Maintain Reit Status Crestbridge